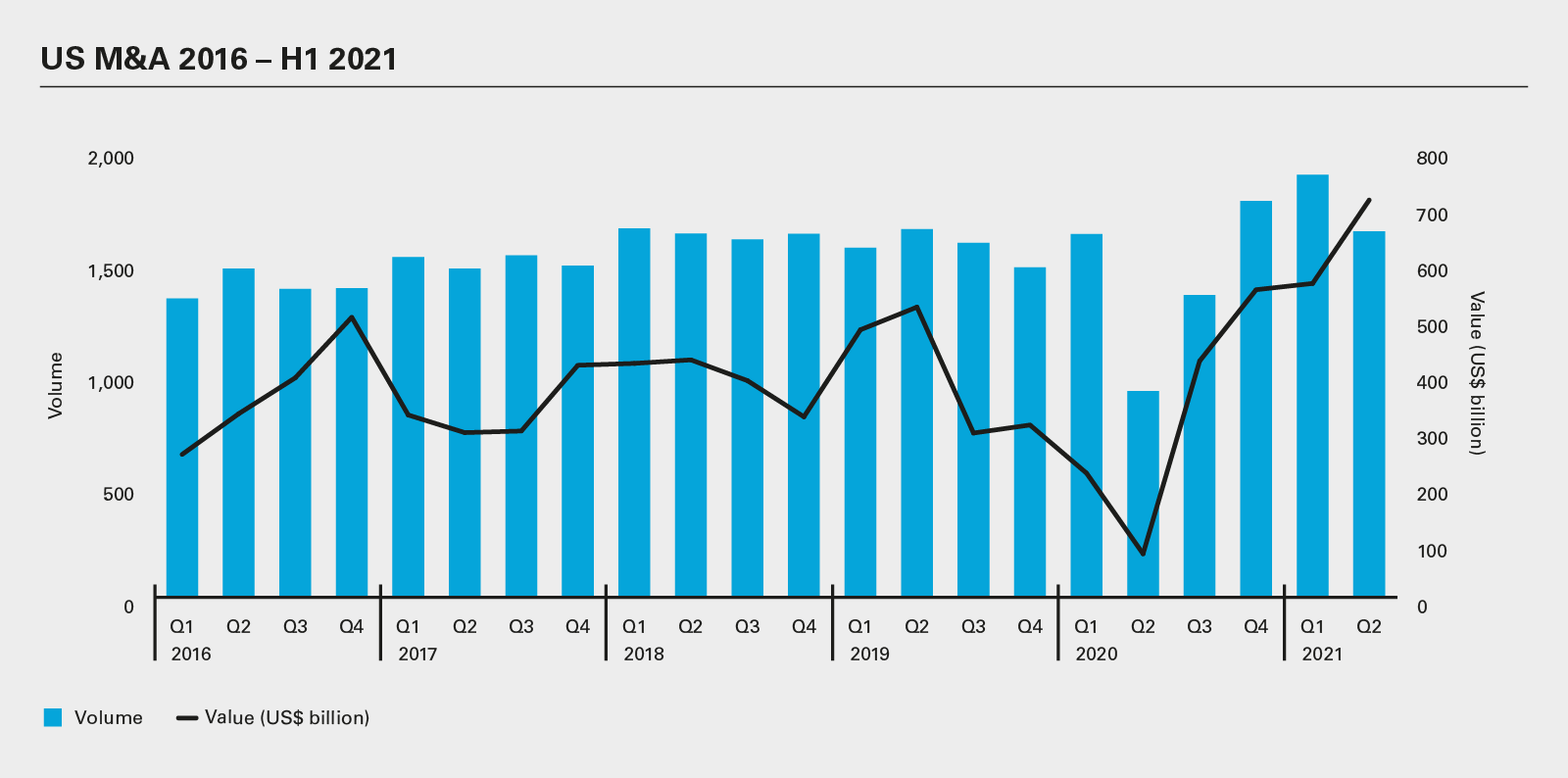

After a brief disruption caused by the COVID-19 pandemic, US M&A has not only returned to form—it has gone beyond previous heights. There were 3,519 US M&A transactions in H1 2021, worth US$1.27 trillion, representing a 38 percent jump in deal volume and a striking 324 percent spike in deal value compared to H1 2020. Not only was this a massive year-on-year increase in value, it represents the highest half-year total on Mergermarket record (since 2006) and matches the total value achieved in all of 2020 (US$1.27 trillion).

US deal activity has been supported by a positive macroeconomic backdrop, with a combination of factors driving M&A. According to the US Bureau of Economic Analysis (BEA), the US economy grew by 6.4 percent, while the IMF is forecasting that US GDP will see annual growth of 6.4 percent in 2021 and 3.5 percent in 2022. A successful COVID-19 vaccination roll-out and an expansive economic stimulus plan, cornerstoned by the Biden Administration's US$1.9 trillion stimulus package, have added to the economic momentum.

In a sign of confidence in the economic rebound, the Federal Reserve indicated in June that it expects to raise interest rates in 2023, after previously signaling that it expected to keep rates at near zero until at least 2024. US stock markets have also been on an upward trajectory. After reaching record highs at the end of 2020, the Dow Jones Industrial Average and S&P 500 continued to rise. Gains were strong through H1 2021, with the Dow Jones and S&P 500 showing gains of more than 13 percent and 16 percent respectively for the year to date.

Debt markets have also been strong, and alongside low interest rates, have ensured that an abundant supply of liquidity has been available to finance transactions. According to White & Case's Debt Explorer, high yield bond and leveraged loan issuance in the US rose to US$545.1 billion at the end of Q1 2021, an increase of more than 37 percent year-on-year.

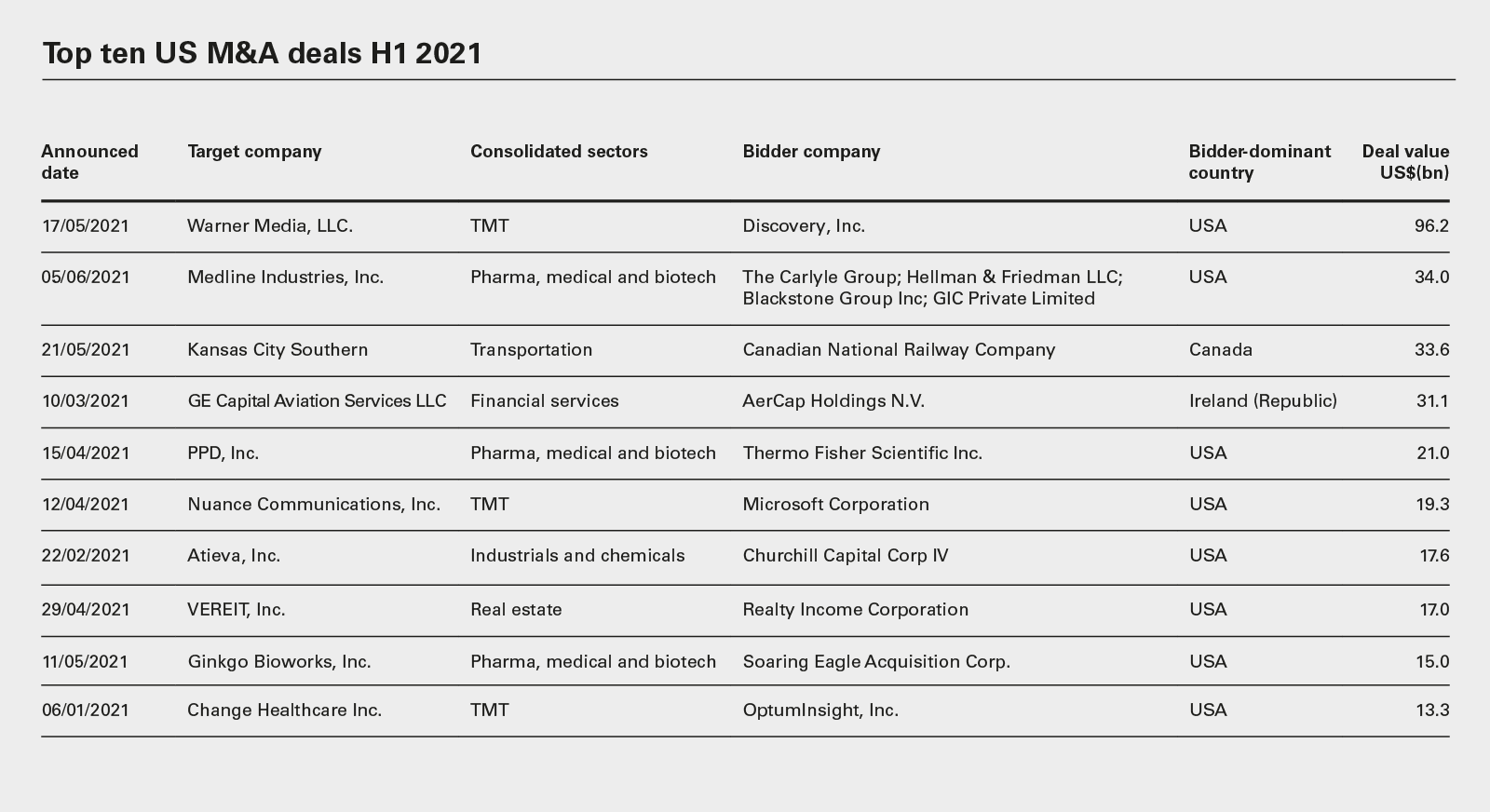

Technology, media & telecoms (TMT) and pharma, medical & biotech (PMB), the two sectors that proved most resilient throughout the pandemic, have remained among the most popular industries for deals and together accounted for six of the ten largest US deals in H1 2021.

The largest US M&A deal of H1 2021, by some distance, was Discovery's proposed acquisition of Warner Media for more than US$96.2 billion. The deal is expected to create the second-largest media company by revenue after Disney. Scale has become increasingly important in the competitive streaming market, which benefitted from the double-digit increase in media consumption observed in the second half of 2020.

The second-largest transaction of the year was the US$34 billion sale of Medline Industries to a PE consortium comprising The Carlyle Group, Hellman & Friedman, Blackstone and Singaporean sovereign wealth fund GIC. The deal demonstrates both the attractiveness of the healthcare industry as the economy transitions out of the COVID-19 pandemic, as well as the strength of the PE industry—the deal is the largest US PE deal since the financial crisis, as well as one of the top PE buyouts ever.

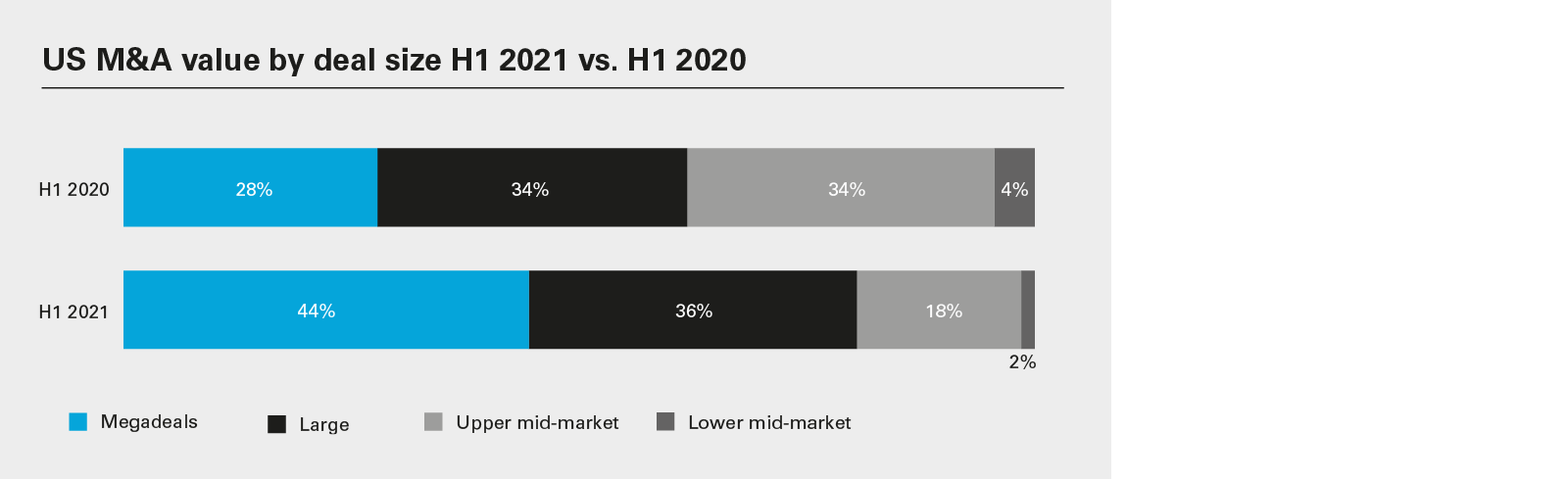

In addition to the presence of cash-rich PE players and resilient activity in TMT and PMB, the progress of megadeals (worth US$5 billion or more) has provided another positive indicator of a recovering market. Such deals accounted for 44 percent of all US M&A deal value in H1 2021—in contrast, they made up only 28 percent of deal value in H1 2020. More jumbo deals point to a confident market where buyers have the conviction to invest large amounts in big-ticket transactions.

Domestic deals dominate

Outbound M&A continued to show strong signs of recovery from the COVID-19 pandemic. Total outbound cross-border deal value came to US$380 billion for the first half of 2021. This represented a 192 percent year-on-year rise and a 59 percent rise on the second half of 2020. Outbound volume for the year so far has increased by 64 percent year-on-year to 939 deals and is 38 percent higher than in the previous six months.

The picture for inbound activity has been more nuanced, with the Biden Administration maintaining the US government's hawkish stance on inbound investments into strategically sensitive industries such as defense, utilities and technology on national security grounds.

There have been 579 inbound cross-border deals into the US so far this year, worth a total of US$228.0 billion. This is up on the 375 inbound deals worth US$51.9 billion recorded in H1 2020, as well as up on H2 2020 figures of 518 transactions worth US$202.1 billion.

Domestic M&A, however, has remained the primary engine of US deal activity. Domestic US deals worth US$1.0 trillion were announced in H1 2021. This is a 35 percent increase in value on H2 2020, and a 321 percent rise on H1 2020. Deal volume of 2,934 in H1 2021 is up on the 2,591 transactions recorded in H2 2020, and 36 percent above the 2,160 posted in H1 2020.

Regulatory woes on the horizon

Over the longer term, the tougher antitrust stance from the Biden Administration could impact M&A in the technology industry. Biden has appointed Lina Khan, one of the most vocal critics of big tech, as chairperson of the Federal Trade Commission (FTC) and Congress has put forward a package of measures that, if enacted, could significantly affect tech companies. For now, however, tech remains the most active and popular sector for dealmaking in the US.

The SPAC boom could also attract greater regulatory scrutiny. SPACs are blank check companies that raise funds on stock markets that are then earmarked for acquisitions. SPAC IPO issuance has hit record levels over the last 18 months. In 2020, SPACs raised unprecedented sums of capital on US stock exchanges, with 248 SPACs securing US$82.6 billion. Before the end of Q1 2021, that had already been surpassed, with 298 SPACs raising US$96.8 billion, according to data from Dealogic.

The increase in SPAC activity has led the Securities and Exchange Commission (SEC) to state that it could introduce additional protections for retail investors.